Quick mortgage calculator how much can i borrow

How much house can I afford. Its free to use and there are no credit checks involved.

Riu43xx1v3nx0m

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

. You get quick wins sooner. Chat to us online if you have a question about using our mortgage calculator. Use our offset calculator to see how your savings could reduce your mortgage term or monthly.

Dont have a mortgage and want to find out what your repayments could be and how long it could take to pay it off. If youd like our help to find the lowest LMI premium then please call us on 1300 889 743 or fill in the details on our online assessment form. Mortgage lending statistics.

Crush the first debt fast. Plan your spending with a budget. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on.

Think carefully before securing other debts against your home. How much can I borrow. Lenders are interested in letting you borrow their money because they make money on what.

FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Theres no such thing as free.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Affordability calculator get a more accurate estimate of how much you could borrow from us. They guarantee a quick process and theyll tell you what youre missing for documents on.

Variable rates from 68 to 85 APR. In most instances other fees are worked into your mortgage too such as your mortgage insurance and homeowners insurance. Between 2015 and 2016 nearly one in three UK consumers chose mortgage products which cost them more than 550 per year.

One or more major banks may be included depending on your search criteria. Use our mortgage calculator to get a rough idea of what you could borrow. Compare home loans on Canstars database.

You could lose your home if you do not keep up payments on your mortgage. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Money Under 30 has created a mortgage pre-approval calculator that can help you understand how much you can really take out to buy a home.

With just a few quick questions our online mortgage calculator will give you an idea of how much you could borrow show your mortgage rates and compare monthly payments. On to the next. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment.

For example the 2836 rule may help you decide how much to spend on a home. Are you looking to buy a home. Most people need a mortgage to finance a home purchase.

You can calculate your repayments for a loan between 2000 and 65000. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. How much can I borrow.

Click here to see our full line of mortgage calculator embed options. How Much Can You Afford to Borrow. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any.

Offset calculator see how much you could save. The mortgage affordability calculator uses your salary details to give an idea of how much you may be able to borrow. Check out the webs best free mortgage calculator to save money on your home loan today.

Use this calculator to figure out how much you could borrow. By working out your estimated loan amount. Lets start by getting you to the right place.

Mortgages are secured on your home. Yep we can predict the future Our debt calculator can show you just how fast you can get there. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

The above list of lenders and lenders mortgage insurers arent ordered this way in our calculators results. Our mortgage payment calculator can help you estimate how much your monthly payments will be simply plug in your loan amount your interest rate and adjust for the length of your loan. The answer is yes.

Please get in touch over the phone or visit us in branch. Start web chat Call us. Additionally a member cannot have more than one Quick Loan open at the same time and can have no more than 3 Quick Loans in a 180-day period.

Using a percentage of your income can help determine how much house you can afford. You can call us on Monday to Friday from 7am to 8pm and on Saturday and Sunday from 7am to 5pm. Weve made it easy for you to better understand your finances with our handy home loan calculator.

The actual amount is based on a number of things including your salary credit rating and how much you can afford to repay after all your. The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest repayments on a. Find out how much you can borrow and your estimate mortgage repayments based on current average fees and latest home loan interest rates.

2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. How much can I borrow. Our calculator includes amoritization tables bi-weekly savings.

Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

Other conditions may apply. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. It takes about five to ten minutes.

Plug in your numbers to get started. That starts with finding out how much you can borrow and what your new monthly payment will be. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be.

The High Cost of Quick Decisions. For Quick Loans opened after 3252020 and until further notice DCU is implementing no payments for the first 60 days after the closing of the loan. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage.

Please be aware that this is only an indication of how much you could borrow. Green Home Improvement Loan has a Variable rate from 650 APR.

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

5 Best Mortgage Calculators How Much House Can You Afford

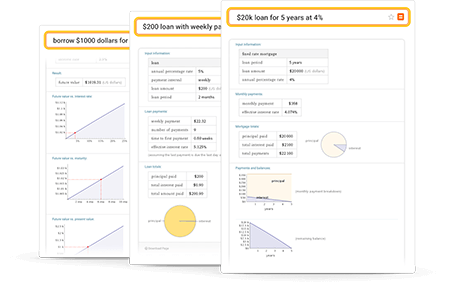

Loan Calculator Wolfram Alpha

Free Mortgage Calculator Free Financial Tools Transunion

5 Best Mortgage Calculators How Much House Can You Afford

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Free Mortgage Calculator Free Financial Tools Transunion

Mortgage Calculator Credit Karma

Va Mortgage Calculator Calculate Va Loan Payments

Can I Afford To Buy A Home Mortgage Affordability Calculator

5 Best Mortgage Calculators How Much House Can You Afford

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

Benefits Of Using A Mortgage Broker Realtor Infographic Www Chrisvininghomes Com Mortgage Marketing Mortgage Brokers Mortgage Humor